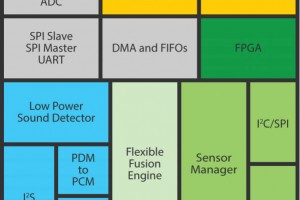

Start-up YorChip specialises in UCIe-compatible IP. Last August the company announced a partnership with FPGA provider QuickLogic to collaborate in developing FPGA chiplets optimised for low power consumption and low cost.

Start-up YorChip specialises in UCIe-compatible IP. Last August the company announced a partnership with FPGA provider QuickLogic to collaborate in developing FPGA chiplets optimised for low power consumption and low cost.

The first FPGA chiplets from the QuickLogic and YorChip partnership are expected to be available in Q2 2025. The chiplets will range in size from 40K LUTs to over 1M LUTs.

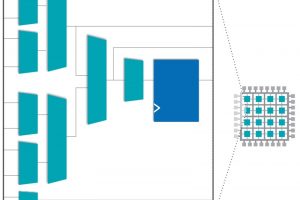

It is 2026 that will be the year of the chiplet, predicted YorChip’s CEO Kash Johal. Chiplets present a compelling case, he said, with the larger die reducing cost and the reticle size resulting in higher yields – doubling or tripling it, said Johal. Other benefits are the possibility to reuse IP block and verification is already completed. Packaging costs are high, he conceded, adding that research is ongoing to reduce the packaging size.

“I think there will be a lot of collaborations like QuickLogic and YorChip, deploying PHY and working together to create solutions. Customers can get a chiplet rather than buy IP and eFPGA and take two to three years to implement it,” he said.

There is no need to buy IP, said Johal. He believes that in five years’ time it will be commonplace for a customer to buy the chiplet they want, put it on a substrate – or use a contractor to put it together – leaving just the final packaging and testing to be completed.

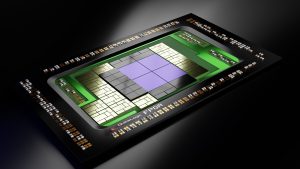

UCIe (Unified Chiplet Interconnect Express) is the interconnect standard supported by AMD, Arm, Google Cloud, Intel Corporation, Meta, Microsoft, Qualcomm, Samsung, and TSMC. Adoption of eFPGA-based UCIe enabled chiplets is expected to open possibilities for a range of applications, including the IoT and AI/ML.

Yole Group estimated a TAM (total available market) of chiplet-based ICs in the consumer, automotive defence, aerospace, industrial, and medical markets in 2032 to be excess of $205bn. In February 2024, Nvidia set a record with Q1 revenue at $26bn, a 262% increase year-on-year, putting the company on track for $100bn sales next year on its own, said Johal.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News

Could you please help me understand the meaning of the paragraph below? It provides a 2023 estimate of $200B yet states now in 2024 that the market is $100B.

“Yole Group estimated a TAM (total available market) of chiplet-based ICs in the consumer, automotive defence, aerospace, industrial, and medical markets in 2023 to be excess of $200bn. The market is already estimated to be valued at $100bn, with Nvidia at $25bn.”

Thank you, Paul. Yole’s estimated TAM is for 2032 (not 2023).

Nvidia’s Q1 2024 revenue was $26bn which is more than a quarter of the way to the $100bn figure from a single company, was the point Kash Johal was making.