Last year started with a minus 8.2% Q1, but quickly and unexpectedly recovered with a 6% growth in Q2, 6.3% growth in Q3 and 8.4% growth in Q4.

“But the wheels fell off in Q1 this year,” said Penn with the strong Q4 23 followed by a minus 5.7% Q1 24 immediately to be followed by an unexpected 6.5% growth in Q2.

by an unexpected 6.5% growth in Q2.

The problem is that the chip industry needs a strong global economy and world GDP growth is expected to be 3.2% this year and 3.3% next year which is not going to deliver it

Unit shipments are below the trendline, unit demand is still soft and the ASP peaked at $1.73 in February and is heading down.

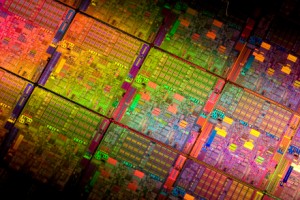

The industry’s growth this year has been driven by a strong memory recovery particularly for HBM and GPUs flying off the shelves which has been good for demand for TSMC’s leading edge processes.

However, the opto market has had negative growth for a year, discretes went negative a year ago and are only just starting to go back up, and “if discretes are down, the broad electronics market is not doing well,” said Penn. The analogue market has had 17 months of negative growth and “if the analogue market is not doing well, it’s hard to think that the overall market can be in good shape,” said Penn.

There is excess capacity at least until the end of 2025 and perhaps longer.

So, for the industry as a whole – not just the memory and GPU sectors – all four of the key driving influences – the world economy, unit demand, capacity and ASPs – are all negative.

For this year, after the minus 5.6% Q1 and the +6.5% Q2, Future Horizons forecasts a +5.6% Q3 and a -1% Q4 for a median figure for annual 2024 growth of 15%, with a bull forecast of 17% and a bear forecast of 13%.

The 2025 forecast is for 1% growth in Q1, 1.6% in Q2, 4.7% in Q3 and minus 1% in Q4 for an 8% median annual growth figure with a bull forecast of 11% and a bear forecast of 5%.

Whatever the immediate fluctuations are, the industry’s long-term technological future looks good, said Penn, with nanosheets now preferred over nanowire and 2nm devices already taped out, with forksheet looking like the candidate for 1nm followed by CFET and, conceivably, quantum dots, and, possibly, logic going 3-D in the same way that flash has done.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News

Malcolm gets the big picture. If you don’t understand the markets, you can’t find, lead and devend your key markets.

The semiconductor market is a lumpy business. Big investments, fabs, Chip teams all chasing new opportunities created by Moore’s law – 2x every other year perf or ½ power – choose wisely.

Fickle consumers buy the shiny new pet rock (Peletreon, Starliner), while leaders focus on the prize and create value – AI moving to the wedge.

Connected and Smarter devices far outnumber people.

Help us see the prize Malcolm

HI DAVID – Future Horizon’s median sales growth forecast for 2024 of 15% is reasonably consistent with the Cowan LRA Model’s most recent prediction of 14.6%.