Let’s take them in reverse order…

5. Horrible Uncertainty

5. Horrible Uncertainty

“There’s a horrible uncertainty about this year which we really don’t know the answers to,” said Malcolm Penn, CEO of Future Horizons, at IFS 2024 yesterday. Last year started with a minus 8.2% Q1, but quickly and unexpectedly recovered with a 6% growth in Q2, 6.3% growth in Q3 and 8.4% growth in Q4. “But the wheels fell off in Q1 this year,” said Penn, with the strong Q4 23 followed by a minus 5.7% Q1 24, immediately to be followed by an unexpected 6.5% growth in Q2.

4. China’s unicorns diminishing

Chinese unicorns are a diminishing breed according to the China Unicorn Enterprise Development Tracking Report published by Great Wall Strategy Consultants. China’s unicorns have fallen from 192 in 2021 to 137 in 2022 to 106 in 2023, says the report. While the number of Chinese unicorns nearly tripled between 2016 and 2023 from 131 to 375, says the report, those that IPO’d fell by more than a third between 2021 and 2023, from 31 to 19. US moves to restrict dollar funds investing in China have affected the funding of Chinese startups.

3. Tri-fold phone gets multi-million pre-orders

3. Tri-fold phone gets multi-million pre-orders

Huawei had received over 3 million pre-orders for its new tri-fold phone last night after opening for pre-ordering last Saturday. The device, called the Mate XT, was publicly unveiled today, comes in red and black versions and does not go on sale until September 20th. In a crowded week for new phones, Apple launched its iPhone16 yesterday for which it is reported to have ordered the production of 86.7 million devices this year. The processors in all four iPhone16 versions are made on TSMC’s NE3 process.

2. Q2 NAND ASP up 15%

The NAND ASP increased by 15% in Q2 and driving total revenue to $16.796 billion – 14.2% up q-o-q, reports TrendForce. All NAND Flash suppliers returned to profitability starting in the second quarter and are expanding capacity in Q3. TrendForce forecasts that in Q3, the ASP of all NAND Flash products will rise by 5% to 10% QoQ. Samsung’s NAND ASP rose by 20% and brought Q2 revenue to $6.2 billion—up 14.8% from the previous quarter.

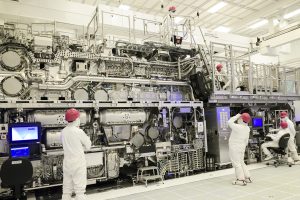

1. Intel Chips Act money delayed by officials

1. Intel Chips Act money delayed by officials

A disconnect between US bureaucracy and Intel has put the main purpose of the US Chips and Science Act in jeopardy. The most important goal of the Act was to restore the US to being a manufacturer of leading edge logic ICs. That meant restoring Intel to being a manufacturer if leading edge logic ICs because it’s the only US company with a plan to make them. Although due $19.5 billion in grants and loans under the Act, Intel has not so far received any of it.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News