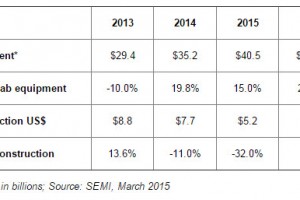

Fab equipment spending increased almost 20% in 2014 and will rise 15% in 2015, says SEMI.

Finance

NXP/Freescale merger ups ARM’s market hold

NXP Semiconductors’ $12bn acquisition of Freescale Semiconductor will create the largest supplier of microcontrollers in the market. This is good news for ARM, because more than half the combined MCU product ranges are designed around on the Cambridge-based processor company’s cores. NXP’s own LPC range of ARM Cortex-M series microcontrollers will sit along the Freescale Kinetis range of Cortex-M chips. ...

Strong start to year for semiconductor sales

January semiconductor sales were $28.5 billion, 8.7% higher than January 2014 and 2% less than December, reports SIA.

Socionext formed from Fujitsu and Panasonic SoC businesses

Today the world has a new semiconductor company – Socionext

Infineon debut in Eurobond market

Infineon has raised €800 million in the bond market to pay off the debt incurred by acquiring IR.

NXP takes over Freescale

NXP is going to buy Freescale for $11.1 billion. Freescale still has $5.5 billion of debt left over from the $10 billion debt imposed on it by Blackstone in 2006 when the private equity company took it over.

ARM looks to the Cloud

ARM has developed an approach for an Intelligent Flexible Cloud (IFC) environment to meet the latency, power and size constraints for next-generation networks.

UK companies in eight ECSEL projects

For many years UK companies have not taken part in EU R&D programmes. This is partly because of UK government meannesss about funding, partly because of UK government imposition of restrictions and partly because of the perceived complications of the paperwork.

ARM adds remote training

ARM has expanded its technical training portfolio to include live courses that can be remotely-delivered in any location. The courses will provide a flexible and fast-response training service for companies and individuals, allowing them to take full advantage of ARM technology features.

NXP in China power jv

NXP and China state-owned investment company JianGuang Asset Management Co. Ltd (JAC Capital) have signed an agreement with the intention to establish a joint venture (JV) in China.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News