This is good news for ARM, because more than half the combined MCU product ranges are designed around on the Cambridge-based processor company’s cores.

NXP’s own LPC range of ARM Cortex-M series microcontrollers will sit along the Freescale Kinetis range of Cortex-M chips.

NXP’s strength is the lower space M3 and M0 devices while Kinetis, which also has M0 devices, is particularly strong with its higher performance M4 and M7microcontrollers.

However, the big gain for NXP will be Freescale’s ranges of higher performance devices based on the Cortex-A cores these are the i.MX, QorIQ and MAC57D automotive processors.

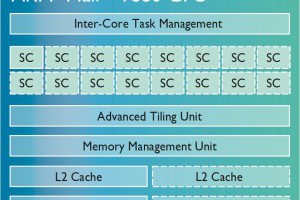

There are also the very high performance multi-core processor system-on-chip (SoC) devices based in the Power Architecture e200/e300 processor cores and ARM’s big.LITTLE Cortex-A57/A7 cores.

The attraction of this for NXP is that the processor based devices are important for embedded industrial and automotive designs.

These have been identified as the most important growth markets by NXP CEO Rick Clemmer.

NXP’s automotive strengths are in the car with dashboard and multimedia systems. Freescale processors are used under the bonnet in engine management and control functions.

Both companies have extensive range of power, analogue and RF chips which are typically used to support microcontroller design-ins.

Freescale’s strengths are in automotive and communications systems and NXP’s are in chip cards and RFID devices.

Annual cost savings have been estimated at $500m, which given the $40bn valuation of the combined organisation does not seem that high.

This may give us an indication of how many of the two product lines will ultimately be carried on by the new merged company.

The acquisition is expected to close in the second half of 2015.

At the same time as the NXP/Freescale merger, and also focused on the rapidly expanding automotive market, the system-on-chip (SoC) semiconductor businesses of Fujitsu and Panasonic have been combined in a new company to be called Socionext.

Socionext will also have an important business for its SoCs in optical communications networks and this business will be centred in Europe, where the new company will operate from offices in Maidenhead in the UK, Munich in Germany and Linz in Austria.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News