All industry gatherings are an opportunity to exchange views, and Electronics Weekly asked Mark Burr-Lonnon, Mouser’s senior vice-president of global service and EMEA, APAC business about market conditions. The market is cyclical, he observes. “The upcycle has started slowly but then we are off to the races. Q3 is looking better and Q4 will be better again,” he says.

All industry gatherings are an opportunity to exchange views, and Electronics Weekly asked Mark Burr-Lonnon, Mouser’s senior vice-president of global service and EMEA, APAC business about market conditions. The market is cyclical, he observes. “The upcycle has started slowly but then we are off to the races. Q3 is looking better and Q4 will be better again,” he says.

The market is slowly picking up, he confirms, with the Americas being strong, partly due to military sales increasing. “Q3 will be interesting as inventory will be depleted and people will need to start ordering again. It has been a case of not double but triple ordering, but by Q3 most of that will have gone. In Q4 a lot of things will be happening in engineering and sales will start to come to fruition,” he predicts.

Already the market is seeing price rises in memory and others will follow, says Burr-Lonnon. “Lead times have also turned the corner, so everything we thought would happen is about to happen,” he adds, with reference to the warehouse expansion to its distribution centre in Dallas-Fort Worth, Texas.

“It’s been quieter in the last two years than we would have liked,” he concedes “but now we have inventory and are closer to market change.”

Intelligence at the edge

The distributor reflected one of the major themes at Embedded World 2024, intelligence at the edge, and announced it has signed Edge Impulse, the software framework provider for embedded machine-learning (ML) applications.

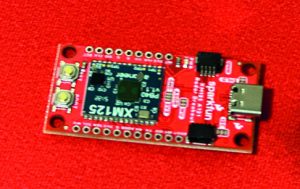

Machine learning is implemented at the edge of the network, explains Mouser’s Mark Patrick, in order to make decisions very quickly at the [network] edge. [Edge Impulse’s] products are designed to enable engineers to build and deploy ML applications very simply and quickly. The tools are hardware-agnostic, continues Patrick, to support any target platforms available from Mouser, for example Nordic Semiconductor’s RF52 and Bluetooth Low Energy, and boards from Thingy, Silicon Labs and Raspberry Pi boards.

Anything with a small footprint, small memory and high performance for edge training can be developed faster, easier and simpler, summarises Patrick.

Mouser customers can gain easy online access to the Edge Impulse software platform through relevant product microsites and learn more about how they can use ML to empower their designs. Edge Impulse users can access compatible hardware, including microcontrollers and development kits, directly from Mouser.

According to the distributor, the worldwide collaboration is designed to remove barriers preventing edge AI and ML development and simplify access to hardware products, streamlining development.

The company also announced a distribution agreement with Macronix, the Taiwanese flash manufacturer at Embedded World.

Developing design ideas

DigiKey built on its recent partnership announcement with Sparkfun, an online hobby electronics store based in Denver, Colorado, and LabsLand, a Spanish university-based programme, to access hardware remotely for higher education, schools and companies for training.

The distributor partnered with NXP for an MCX MCU design contest, in which entrants use NXP’s new FRDM development boards, featuring its MCX N and MCX A series MCUs, to submit design ideas.

The first prize is a 14-inch MacBook Pro, an Apple Watch Series 9 and AirPods Pro, the second prize is an e-bike and the third prize is a $750 DigiKey gift card. Twenty-five runners-up will be selected to receive ‘swag packages’.

Entries close on 20 May 2024 (with final projects then submitted by 31 July) and the winners will be selected by 15 August.

An air of independence

During the recent volatility, independent distributors have been finding buyers for surplus inventory by being agile with creative financial options to preserve cash outlay and identifying ways to reduce electronic component costs, writes Del Williams.

As manufacturers have found many critical electronic components hard to come by, or watched prices skyrocket and lead times extend, they are looking to secure their supply chain and prepare for what will be inevitable disruptions in the future. They want to do this at reduced cost and capital outlay after paying a premium for electronic parts over the past several years, says independent distributor Classic Components, based in California.

As manufacturers have found many critical electronic components hard to come by, or watched prices skyrocket and lead times extend, they are looking to secure their supply chain and prepare for what will be inevitable disruptions in the future. They want to do this at reduced cost and capital outlay after paying a premium for electronic parts over the past several years, says independent distributor Classic Components, based in California.

“We just went through one of the biggest supply chain disruptions in history outside of a world war,” says vice-president and global general manager Mike Thomas. “Now, things are starting to settle down. Interest rates have risen sharply, which is having the expected result of slowing the economy and so demand is down. However, the supply chain is still highly vulnerable to present and future disruptions.”

He believes change may be the only constant in the industry. Covid-related supply chain shortages are not the only disruption to affect global manufacturers. In 2018 there was also a worldwide shortage of multi-layer ceramic capacitors (MLCC) when demand outpaced supply. At the time, 60% of the world’s production of MLCCs was controlled by three suppliers. Even now, there are components in short supply due to the limited number of suppliers, geopolitical trade tensions and ever-changing technology, the company says.

As a result, manufacturers are taking steps to secure the supply chain in the long term. A key strategy is to be less dependent on China and more diversified in sourcing the electronic components needed to manufacture their products, says Thomas.

There will also be a continued role for independent distributors. When franchised/authorised distributors were not able to supply the required parts, independent distributors stepped in during the pandemic and played a critical role in helping keep many manufacturers’ production lines running. Independent distributors can leverage their extensive expertise and decades of strategic relationship building to find alternate sources through regional authorised/franchised distribution, manufacturer direct, or surplus/ excess inventories.

According to Thomas, in 2023, many manufacturers were sitting on excess inventory due to stockpiling parts and ordering from multiple sources to ensure delivery. After having to pay exorbitant prices to secure parts, many manufacturers are looking to reduce costs further, even as prices drop. Some are looking to take advantage of financial services that some independent distributors provide to minimise cash outlay while ensuring access to inventory.

Inventory levels

When manufacturers faced tremendous lead times on parts, many double, triple, or quadruple ordered since they did not know who was going to deliver first, says Thomas. “Now that all these parts were delivered, some manufacturers have excess inventory and aren’t sure what to do with it.”

If it is true dead stock, an independent distributor can help liquidate the electronic components and get them off the books through various types of arrangements initiated with a simple email list of surplus items with the original price paid for an independent distributor to search its database to see if any other customers use those parts and can broker a deal between the parties.

Another option is to list and sell surplus inventory on consignment with, or without, taking physical possession of the inventory. “As we receive inquiries, we share the information so you can decide whether to sell [your surplus] at the offered rate,” explains Thomas.

It may even be possible to purchase the inventory outright to resell it later. “We buy excess inventory every day and can make purchases on a line-item basis,” says Thomas.

With costs rising and inflation still not under control, manufacturers are also looking to reduce the expense of procuring parts. Some independent distributors have found ways to lower the cost of parts by leveraging their global relationships.

With a comprehensive global network the independent distributor can make purchases in local markets that currently offer the lowest prices and pass the savings to their customers.

Regional quality centres and logistics hubs provide the flexibility to purchase components from any country, in any currency and ship them to where they are needed, explains Thomas.

Manufacturers may also seek financial or logistical services when their cashflow is constrained or they want to optimise their working capital. In some cases they can even make speculative purchases for a customer and/or provide financing to purchase inventory when a qualified client has capital constraints.

To improve manufacturers’ cashflow, independent distributors can offer tailored programmes of vendor-managed inventory, which can simplify logistics, reduce the total cost of ownership and enable the redirection of capital to other spending categories. In some cases they can even make speculative purchases for a customer and/or provide financing to purchase inventory when a qualified client has capital constraints.

“Financial and logistical services can be customised to the manufacturer’s particular needs and situation, which may evolve over time. The goal is a win-win partnership that mitigates their capital and logistical concerns,” concludes Thomas.

Another factor that could affect the supply chain is the reshoring effort spurred by the passing of the Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022 (CHIPS Act). “They may not be saying it, but parts built in the United States are going to cost more than the parts from Taiwan. It will start to affect pricing structures at some point.

“You want to have that relationship with a partner that is flexible enough to shift gears in a moment’s notice,” explains Thomas. “You may be in shortage mode on Monday, and then Tuesday, you have excess and want help selling it. Then on Wednesday, you decide you don’t want to sell any more and prefer we loan you money against it.”

Del Williams is a technical writer, specialising in business and technology.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News