Keysight Technologies comes into existence this month following the decision of Agilent Technologies to separate its life sciences and test businesses, creating the new company.

There is a strong awareness for the company’s history in test and measurement technologies going back to Hewlett-Packard.

The role of the new company is how to make the best of this measurement science capability in a test market asking for a range of different hardware instrument formats, from benchtop to modular.

There is also the growing importance of software. Not so long ago software was used to control instruments and store data. Now software is used to configure test instruments based on a common hardware platform.

This is a long way from the instrument-based test market defined 50 years ago by HP.

But Keysight is not overly attached to benchtop instruments, despite them making up a large proportion of its sales. It is no longer uncertain about the role of the modular instrument based on standard high speed buses such as PXI and AXI.

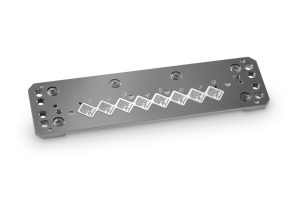

A recent example is a 26.5GHz two port vector network analyser, the M937XA, which is offered in a single-slot PXIe module.

It is designed so that 16 modules can be configured in a PXIe chassis supporting parallel test with up to 32 ports.

“Modular is about parallel-test, it is not about performance. PXI has its performance limitations,” says Frank Berthaux, Keysight Technologies marketing manager EMEA.

For example, the company has recently introduced an arbitrary waveform generator, the M8195A, capable of delivering 65Gsample/s on four channels. It has a 20GHz bandwidth.

This instrument is not offered in a PXIe module, but in the company’s larger AXIe format.

“This instrument was not feasible in PXIe format,” says Berthaux.

The company’s product strategy has changed so that it can address the various hardware formats in a cost-effective away.

“The approach is to design a single instrument and then take it to market in different formats – benchtop, handheld or modular,” says Chris Rennie, Keysight Technologies, general manager EMEA.

The company recognises the importance of the modular instrument market. It has one of the market’s largest ranges of PXI bus-based instrument modules with various levels of software configurability.

“Fully software-defined hardware, this is the next step and something we are taking very seriously,” said Rennie.

But Keysight has not yet decided whether this growth in the modular test segment of the market will impact its traditional benchtop business.

“Of course we are looking at this very closely,” said Rennie.

Another challenge is finding a way to implement its “measurement science”, which relies on significant R&D investment, in the lower cost instruments which most markets require.

Another challenge is finding a way to implement its “measurement science”, which relies on significant R&D investment, in the lower cost instruments which most markets require.

Keysight knows it must continue to make the investment in R&D, which will keep it at the leading edge of measure science.

“Measurement science is more important than test instrument form-factor,” says Rennie.

The challenge then is to find ways of spreading this advanced technology down through a growing list of product types. Ultimately, this will mean implementing the technology in lower cost instruments, which are a focus of the new company.

The test services business is another new focus for Keysight.

The company has an established calibration services business, but one of the aims for the new company is to grow this substantially. It will also add an asset management business and training services.

Keysight has identified the services business as a growth opportunity, perhaps growing faster than the hardware test market which has matured to steady, but not exceptional growth rates in recent years.

“We believe the services side of the business will be a big differentiator, it can sustain and support the hardware/software test business,” says Rennie.

This could be an astute move, and not only an accounting convenience to create a second business unit within the new company.

Still, Keysight’s biggest asset remains its heritage in measurement science, and Rennie says the new company is committed to increasing R&D investment to sustain this.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News