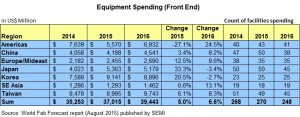

Spending in fab equipment will rise 11% to $38.7 billion this year, days SEMI, and another 5 % to $40.7 billion in 2016 . IDM fab capex is will increase almost 6% in 2015 and over 2% in 2016.

Currently there are are 48 DRAM fabs and 32 NAND fabs, says SEMI, and this year 36 fabs will be under construction representing investment of over $5.6 billion in 2015 and next year there will 20 fabs under construction representing investment of over $7.5 billion.

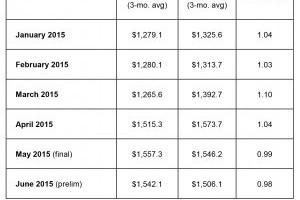

Equipment spending in 2015 will be driven by memory and foundry – with Taiwan and Korea projected to become the largest markets for fab equipment at $10.6 billion and $9.3 billion, respectively.

The market in the Americas is forecast to reach $6.1 billion, with Japan and China following at $4.5 and $4.4 billion, respectively. Europe/Mideast is predicted to invest $2.6 billion. The fab equipment market in South East Asia is expected to total $1.2 billion in 2015.

America’s fab equipment capex will be $6.1 billion in 2015, down 22% on 2014; China will spend $4.4 billion up 10% on 2014; EMEA will spend $2.6 billion up 18% on z2014;japan will spend $4.5 billion up 17% on 2014; Korea will spend $9.3 billion up 27% on 2014; S.E.Asia will spend $1.2 billion up 2% on 2014; Taiwan will spend $10.6 billion up 25% on 2014.

SEMI is a global industry association serving the nano- and microelectronic manufacturing supply chains, with 1,900+ memberss.

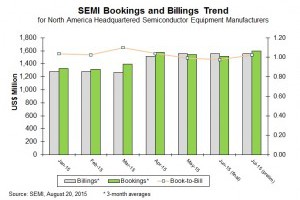

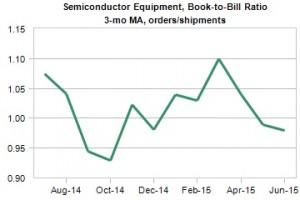

See also: SEMI b-to-b stays positive

See also: SEMI’s April book-to-bill is 1.04

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News