GloFo, working with Synopsys, Cadence and Mentor, has developed new digital design flows for RTL to GDS implementation for its 14nm finfet process. Integrated with a technology-proven process design kit (PDK) and early-access standard cell libraries, the flows create a digital design “starter kit” that provides designers with a built-in test case for out-of-the-box physical implementation testing and analysis of ...

Finance

Silicon still rules in power electronics

Despite the increasing use of wide-bandgap materials like SiC and GaN, silicon will account for 87% of the $20 billion power electronics market says Lux Research. Innovations in circuit design, control methods and module packaging will help silicon hold off adoption of WBG materials in many applications, particularly in the near-term on account of silicon’s high availability and volumes. Lux ...

Why is Altera so important to Intel?

Intel plans to buy FPGA company, Altera. If successful, and it is difficult to think of a reason why it shouldn’t, the $17bn deal will be Intel’s largest ever acquisition. On an Intel scale, Altera is a relatively small company with sales revenues of $2bn in 2014. Intel is paying a fairly high price for the company. So what has ...

Nantero raises $31.5 million for nanotubes

Nantero, the Boston carbon nanotube IC specialist, has raised another $31.5 million. “We were targeting $15 million and ended with more than double,” Nantero Co-Founder and CEO Greg Schmergel told Electronics Weekly.

Does Intel see Altera as key to SoC market?

Intel’s takeover of FPGA supplier Altera seems to be back on. Reports over the weekend from the US seem to indicate that the processor firm will make a $17bn bid to buy the FPGA maker, perhaps today. A previous takeover move earlier this year failed on price. It seems that Intel is now prepared to increase its offer to well ...

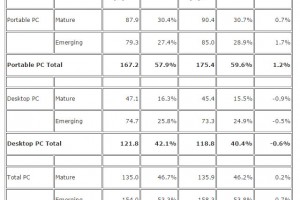

PCs and tablets down this year, says IDC

For the 4th year running, PC shipments will decline this year, says IDC, while tablet and 2-in-1 sales will also decline but more slowly.

Comment: Qualcomm, Avago/Broadcom is coming for you

Watch out Qualcomm, Avago/Broadcom is coming for you. This is the clear message from the agreed $37bn deal which will see Avago Technologies acquire Broadcom. This has the potential to be the largest and most significant merger in the semiconductor industry since the hiatus of the credit-crunch in 2008/9, perhaps of all-time. It is no surprise it addresses the communications ...

Japan’s Eidec makes EUV resist that could speed EUV production 10x

A highly sensitive resist which could speed up EUV production by 10x has been developed by Japan’s EUVL Infrastructure Development Centre (Eidec).

Avago to buy Broadcom

Avago Technologies has agreed to acquire Broadcom in a $37bn deal. The deal will create a major supplier of communications chips with annual revenues of approximately $15bn, around $8bn of which belong to Broadcom. This would make it larger than Texas Instruments comms business but smaller than market leading wireless chip supplier Qualcomm. The combined company will adopt the Broadcom name. ...

NXP agrees $1.8bn RF sale to fund Freescale merger

NXP Semiconductors has agreed to sell its RF power business to Chinese private equity firm Jianguang Asset Management for $1.8bn. The sale of the RF power business, which supplies RF power amplifiers to the mobile phone basestation market, seems to have been a element in the proposed merger of NXP with Freescale Semiconductor. Proceeds from the sale of the RF Power business will ...

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News