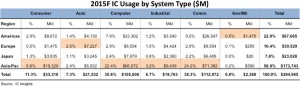

IC Insights expects 2015 sales to split: US $68 billion, Europe $32 billion, Japan $23 billion, and ASia/Pac $174 billion for a total market of $395 billion.

Asia-Pac is particularly dominant in computer and comms which will account for 74% of semi sales this year with comms representing about 39% and computer about 35%.

Europe is forecast to account for the largest share of the automotive IC market in 2015, but IC Insights expects the Asia-Pacific region will achieve top share of that segment in 2016 as China continues to account for a large and growing portion of new car shipments.

That will leave only the Government/Military end use segment where Asia-Pacific does not have top IC market share—a condition that is forecast to hold through 2018.

From 2012-2018, the two highest growth end-use markets for ICs are forecast to be the industrial and communication segments, having CAGRs of 9.1% and 8.2%, respectively.

The automotive IC market is forecast to a CAGR of 6.1% from 2012-2018, yet automotive’s share of the total IC market is forecast to remain below 8.0% throughout this time.

In 2015, analog ICs are forecast to represent the greatest share of IC sales among automotive (43%) and industrial (50%) applications; logic devices are expected to account for the greatest share of IC sales within government (33%) and consumer (19%) systems, and MPUs (60%) are forecast to account for the greatest share of IC sales in the computer segment, says IC Insights.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News