Cree will supply 150mm bare and epitaxial silicon carbide wafers to ST over “several years”, according to Cree.

“Expanding our long-term wafer supply agreement with Cree will increase the flexibility of our global silicon carbide substrate supply,” said ST CEO Jean-Marc Chery. “It will further contribute to securing the required volume of substrate we need to manufacture our silicon carbide-based products as we ramp up production over the next years for automotive and industrial customers.”

“Silicon carbide delivers performance enhancements that are critical to electric vehicles and industrial solutions for solar, energy storage and UPS systems,” claimed Cree CEO Gregg Lowe – and it is automotive and industrial customers that ST is aiming at.

ST appears to be on a mission to build a solid SiC supply chain.

In February it acquired a majority stake in Swedish SiC wafer manufacturer Norstel, and with its Q3 results announced that it will exercise its option to purchase the remaining 45% stake, and now expects to close this during Q4.

ST’s ambition is to be a leader in SiC mosfets and diodes, said a ST spokesman, in a market the firm estimates at $3B annually by 2025.

The original Cree supply agreement was also signed earlier this year, and doubled in value by extension

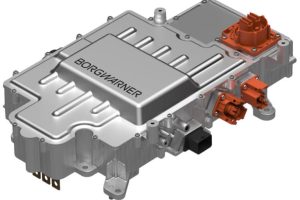

Silicon carbide transistors are more expensive than similar silicon parts, but faster, more rugged and can be lower loss. The result is smaller lighter chargers, power inverters and motor controllers – something that is tempting electric vehicle makers, particularly, some claim, as overall system cost savings are to be had.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News