In 2010, the administrator sued Infineon for $3.35 billion claiming that Infineon had transferred operations to Qimonda at an inflated price.

“As a result of the payments, Infineon will utilize the provisions set aside for the legal dispute,” says Infineon, “the amount in excess of this will have a negative impact on earnings and cash flow from discontinued operations.’

In 2006, Infineon had spun off its DRAM unit into a separate company which it named Qimonda. When Qimonda was hit by a collapse of the DRAM market in 2009, it tried to agree a rescue package amounting to €325 million being delivered by the State of Saxony, the government of Portugal and Infineon, which at that time owned 77.5% of Qimonda, but the arrangements could not be completed before it became necessary to file for insolvency, said Qimonda at that time.

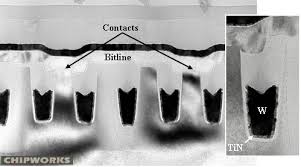

Qimonda had an innovative buried wordline DRAM technology which has advantages in delivering a small chip size and high performance with low power. The technology was picked up by the Taiwanese DRAM producer Winbond.

The administrator says that Qimonda’s insolvency will be completed next year with substantial dividends for the creditors.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News