Revenues are projected to continue growing in 2025, with DRAM expected to increase by 51% and NAND Flash by 29%, reaching record highs.

DRAM ASPs will rise by 53% in 2024 and 35% in 2025.

DRAM revenue will reach $90.7 billion in 2024—a 75% YoY increase—and $136.5 billion in 2025—a 51% YoY increase.

Four factors driving the revenue growth of DRAM are: the rise of HBM, technological evolution, restrained capital expenditures y manufacturers limiting supply, and the recovery in server demand.

HBM is expected to contribute 5% of DRAM bit shipments and 20% of revenue in 2024.

DDR5 and LPDDR5/5X will help raise the ASP. DDR5 will account for 40% of server DRAM bit shipments in 2024, increasing to 60–65% in 2025.

LPDDR5/5X is expected to contribute 50% and 60% of mobile DRAM bit shipments in 2024 and 2025, respectively.

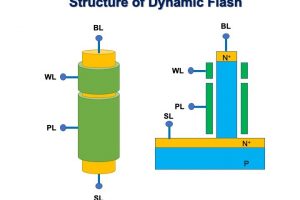

NAND Flash revenue is expected to hit $67.4 billion in 2024, a 77% YoY increase. In 2025, driven by the rise of high-capacity QLC enterprise SSDs, the adoption of QLC UFS in smartphones, restrained capital expenditures by manufacturers limiting supply, and the recovery in server demand, NAND Flash revenue is expected to reach $87 billion—a 29% YoY increase.

North American CSPs have already begun extensively adopting QLC enterprise SSDs in inference AI servers, especially those with high-capacity specifications.

TrendForce estimates that QLC will contribute 20% of NAND Flash bit shipments in 2024, with this share expected to increase in 2025.

In smartphone applications, QLC is expected to gradually penetrate the UFS market, with some Chinese smartphone manufacturers planning to adopt QLC UFS solutions starting in Q4 2024. Apple is anticipated to begin incorporating QLC into iPhones by 2026.

TrendForce reports that with record-breaking revenues in the memory industry, manufacturers will have sufficient cash flow to accelerate investments.

Capital expenditures in DRAM and NAND Flash industries are expected to increase by 25% and 10%, respectively, in 2025, with the potential for further upward revisions..

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News